A rounding backside is a share market chart sample that is used in technical analyses to showcase a main reversal pattern. In this, there are primarily 3 phases which are downtrend, backside and breakout. Inside the downtrend, the value is falling, whereas at the backside, the worth goes down slowly, stabilizes and starts rising.

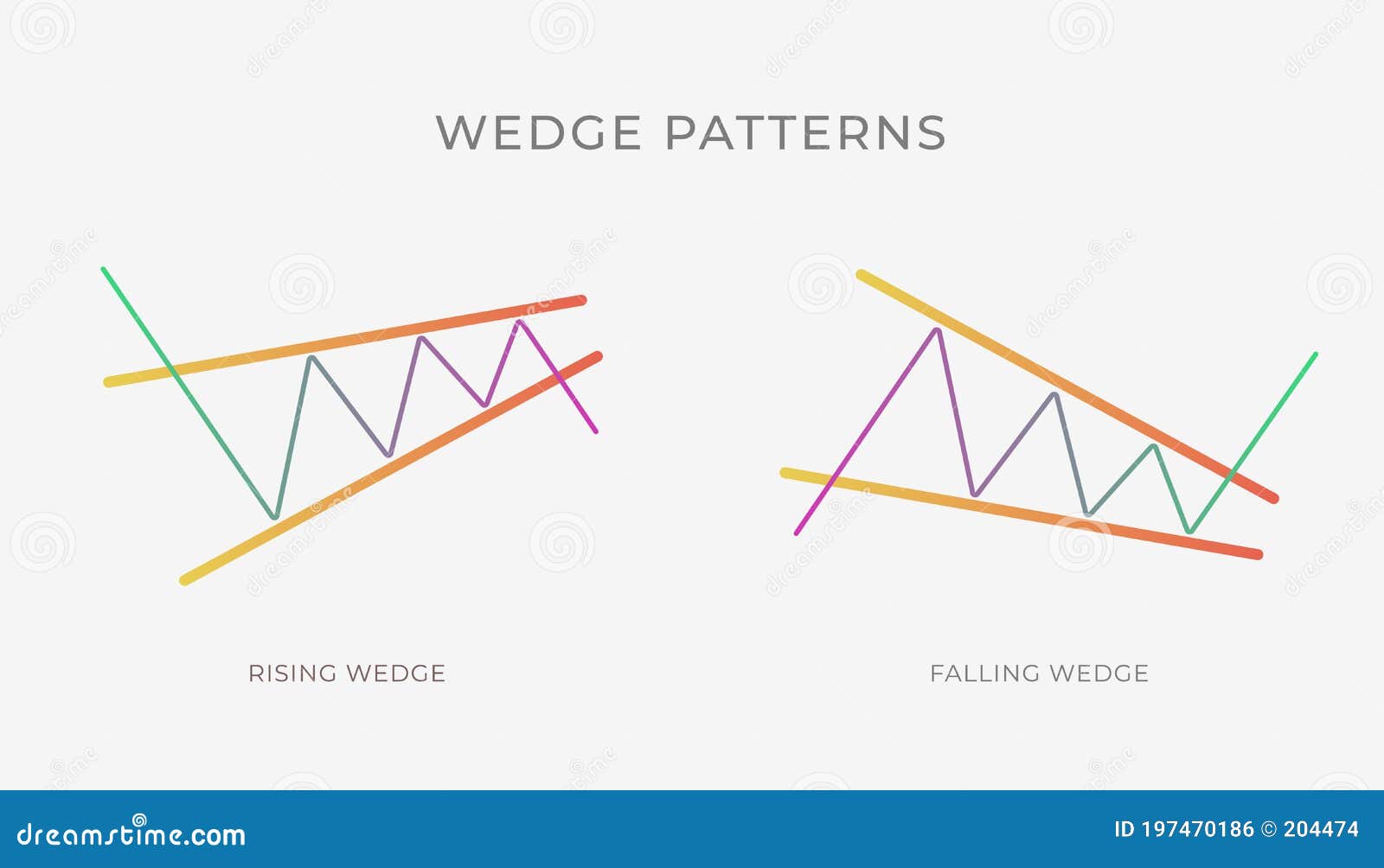

Generally it might be created as a part of a reversal on the end of a downward pattern, but more commonly it is a continuation. It usually happens inside a downtrend and suggests a potential reversal. The narrowing worth range and better lows point out diminishing promoting https://www.xcritical.in/ strain and a possible shift towards bullish momentum.

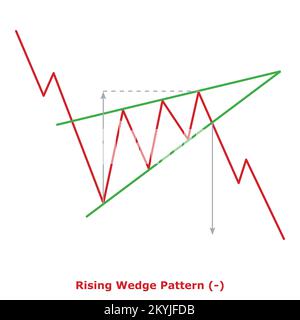

What’s A Wedge Pattern?

The likelihood of a neckline break increases after the third unsuccessful try to interrupt the resistance. The triple high pattern forms much less frequently than the double top sample as a outcome of there’s one less peak to occur. Additionally, a downward sample tends to signal falling wedge chart pattern a potential drop within the value of inventory and securities. When a falling wedge sample is seen throughout a downtrend, it may point out a possible change to an upward trend.

- It develops after an uptrend and consists of three peaks, with the central peak (head) being larger than the 2 flanking peaks (shoulders).

- It is formed when the prices are making Decrease Highs and Decrease Lows compared to the earlier worth movements.

- If the decrease trendline experiences a breakdown, this marks the start of a model new bearish pattern.

This incidence suggests a potential reversal of the prevailing bearish development and a shift in the direction of an upward trend. The double bottom pattern offers a powerful indication for traders to assume about buying, because it signifies that the bears could additionally be shedding their grip in the marketplace. Let’s discuss concerning the falling wedge pattern or the bullish wedge pattern over here.

Tips On How To Determine A Chart Pattern?

Now that we now have understood the basics of falling wedge patterns, we’ll discuss the steps listed beneath used to determine and trade the falling wedge pattern. For a reversal to occur, there should be a pre-existing trend, very like different reversal patterns. The descending broadening wedge can emerge on numerous time frames, indicating a potential reversal in brief, intermediate, or long-term tendencies https://kirootoconsulting.com/mastering-crypto-ramps-key-factors-for-web3/.

Falling Wedge: A Bullish Reversal Sign

Inside the context of an uptrend, the ascending triangle sample Digital asset is a useful sign for bullish continuation. When the value breaks above the resistance line, it indicates a bullish continuation. Traders usually use this pattern to bolster their confidence in maintaining lengthy positions or contemplating new ones.

It is characterized by a pennant (a small symmetrical triangle) that types because the market consolidates. The breakout from this consolidation sometimes occurs to the upside, signaling a continuation of the uptrend. This shopping for strain creates demand for the stock, pushing prices larger. As the uptrend continues, some traders could start to take earnings or shut their positions.

This sample is normally adopted by a reversal within the downtrend to the upside. In order to know the falling wedge pattern, allow us to first attempt to perceive what a wedge means. Whereas you’re understanding the wedge sample technique, you need to have an concept about its benefits and limitations throughout the stock market. Maintain reading this text to know every little thing about wedge sample trading technique and how to use it to determine value developments. The traders should take a long place when the costs break above the upper converging pattern line.