And even within the manufacturing line of business, a manufacturer in the aerospace sector will have a much different looking chart of accounts than one that produces computer hardware or even clothing apparel. Nevertheless, the exact structure of the chart of accounts is the reflection on the individual needs of each entity. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

Organize account names into one of the four account category types

Run a series of transactions through your COA to test its functionality and practicality. Tailor these categories and subcategories to reflect your business’s unique operational needs, ensuring they capture all types of transactions your business encounters. The numbering system forms the foundation of your chart of accounts, offering a structured method to organize financial information. It’s designed to be intuitive and scalable, allowing for future growth without requiring a complete redesign.

What does a COA normally include?

The COA has been a fundamental component of accounting systems for centuries, evolving with accounting practices. While we can’t name the exact date when it became a standard accounting practice, we can trace its evolution through history – from tally sticks to accounting software. Liabilities are the amounts of money a company owes to others or the obligations it needs to fulfill in the future. Think of debts to suppliers, loans from banks, or unpaid expenses – they are your liabilities. The total assets amount represents the value of all the company’s resources. You can have multiple asset accounts, each representing a different type of asset.

- Additionally, by streamlining accounting processes, the COA enhances efficiency and minimizes errors – a critical advantage for businesses with complex transactions.

- Consider integrating it with all your sales sources and payment systems to create a single source of truth about your business finances.

- Large and small companies use a COA to organize their finances and give interested parties, such as investors and shareholders, a clear view and understanding of their financial health.

- Below, we’ll go over what the accounting chart of accounts is, what it looks like, and why it’s so important for your business.

- This significantly aids organization in financial analysis, compliance, and decision-making.

Gross Profit: What Is It and What It Means For Your Business

It doesn’t include any other information about each account like balances, debits, and credits like a trial balance does. SAP S/4HANA Cloud aids in simplifying the maintenance of a chart of accounts (COA) by providing a set of standard G/L accounts and related settings. You can use these standard resources to map onto your existing chart of accounts and even expand it if necessary, during implementation.

Free Course: Understanding Financial Statements

When allocating account codes (chart of accounts numbers) don’t forget to leave space for additional accounts and codes to be inserted in a group at a later stage. For example the inventory codes run from 400 to 499 so there is plenty of room to incorporate new categories of inventory if needed. A chart of accounts (COA) is a structured list of an organization’s financial accounts used to categorize and record financial transactions. It serves as the backbone of an accounting system, providing a framework for organizing financial data in a logical manner. The COA is tailored to an organization’s needs and can vary widely in complexity. Yes, it is a good idea to customize your chart of accounts to suit your unique business.

All Categories

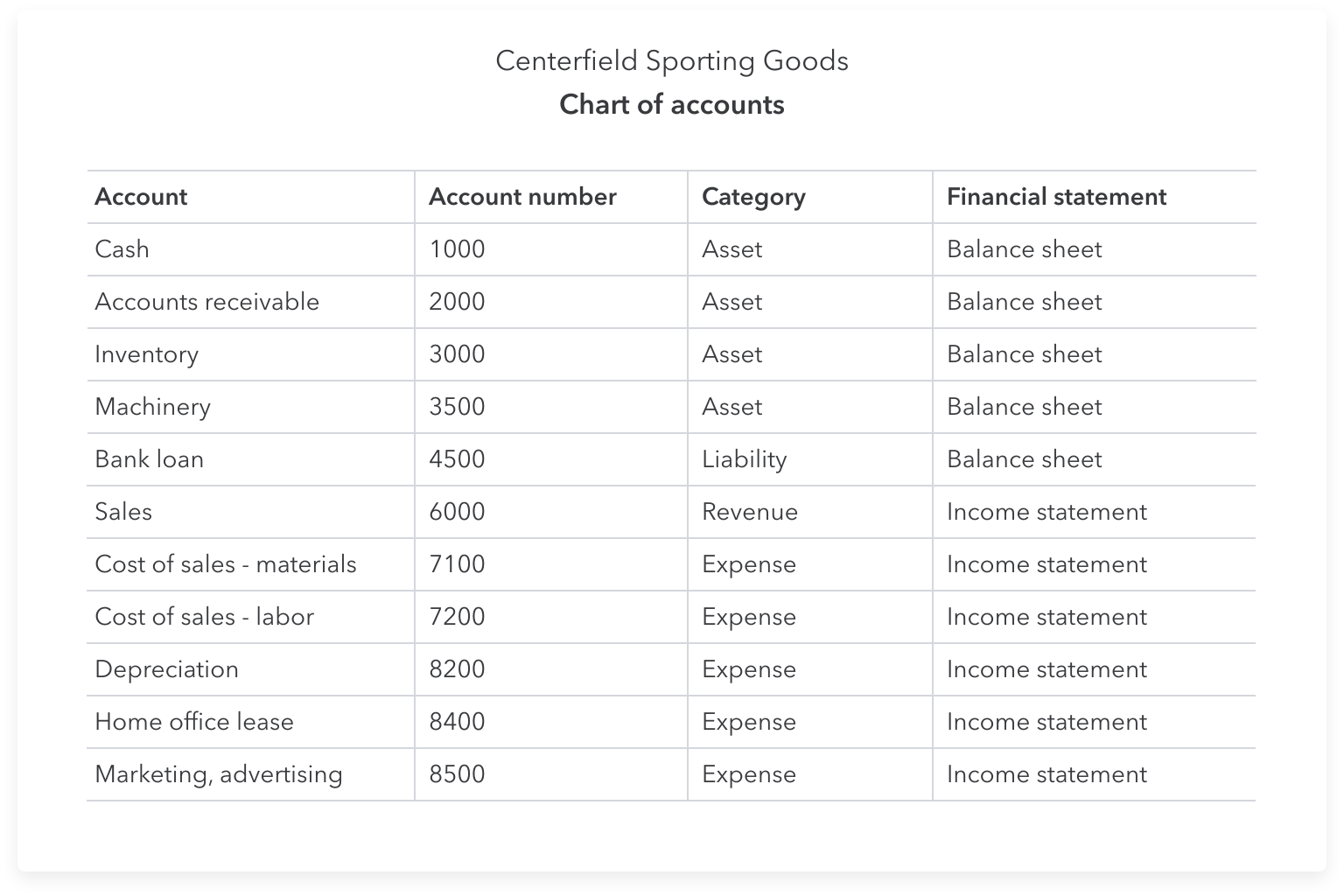

This column shows the financial statement in which the account appears, and for a profit making business is either the balance sheet of the income statement. The chart of accounts often abbreviated to COA, is the foundation of the double entry bookkeeping how to design products with operations management in mind system. It is basically a listing of all the accounts found in the general ledger that the business will use to code each bookkeeping transaction. This sample chart of accounts provides an example using some of the most commonly found account names.

For example, you might use the 1000 series for current assets, starting with Cash at 1010, Accounts Receivable at 1020, and so on, leaving room between numbers for future accounts. Current liabilities, or short-term liabilities, are obligations that are due within one year. These include accounts payable, wages, taxes owed, and current portions of long-term debt which are crucial for managing immediate financial responsibilities. Importantly, the COA is designed to be adaptable, evolving with the business to include new accounts as necessary, ensuring its continued relevance.

It all depends upon the company’s needs, nature of operations, size, etc. In any case, the chart of accounts is a useful tool for bookkeepers in recording business transactions. Accounts are classified into assets, liabilities, capital, income, and expenses; and each is given a unique account number. The Chart of Accounts (COA) is a foundational tool in accounting, serving as the backbone of a company’s financial recordkeeping system. This guide offers an in-depth exploration of the chart of accounts, providing definitions, an example, and a downloadable template to enhance your financial organization and reporting. The Industrial Revolution resulted in technological advancements and changes in production methods.

Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites. At the end of the year, review all of your accounts and see if there’s an opportunity for consolidation. Here’s how to categorize transactions in QuickBooks Online and navigate the COA. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. No, but it’s considered necessary by all kinds of companies seeking to categorize all of their transactions so that they can be referenced quickly and easily.